Alpena and Clare soon to welcome ALDI Grocery Stores

FOR IMMEDIATE RELEASE

March 18, 2024

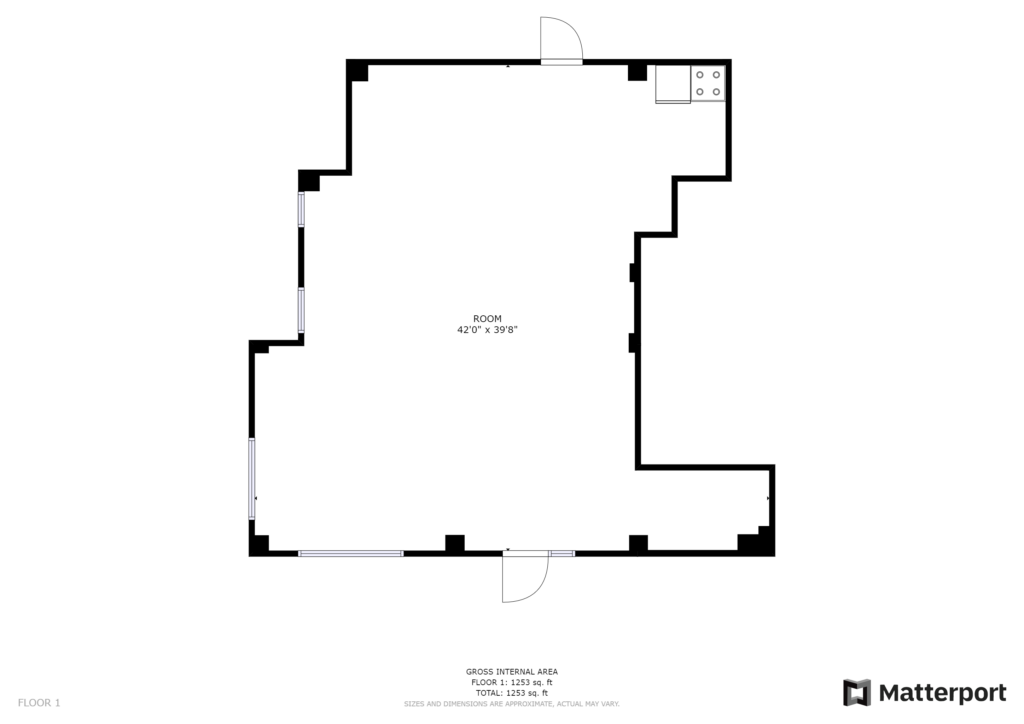

LANSING, Mich. – ALDI is investing approximately $9.9 million to bring two new locations to rural communities in Michigan. ALDI will build and equip the two new stand-alone grocery stores in rural Michigan communities that together, will comprise approximately 42,900 square feet of space and feature a range of products including fresh meat and seafood, organic produce, and pantry essentials. The developments are being supported with an $8-million New Markets Tax Credit allocation from Michigan Community Capital.

ALDI is one of America’s fastest growing retailers and offers shoppers groceries at everyday low prices in more than 2,300 stores in 38 states. ALDI focuses on the groceries commonly purchased by shoppers, primarily under its exclusive brands, and is committed to providing customers with the highest quality products at the lowest possible prices. ALDI strives to reduce the company’s impact on the environment through an energy efficient store design, including state-of-the-art lighting and refrigeration systems that have reduced energy features and environmentally friendly building materials.

ALDI will bring grocery stores to Alpena and Clare, both rural Michigan communities where increased affordable, fresh food is greatly needed. Approximately 20 new full-time equivalent positions will be created to support the new stores. All positions will be accessible to individuals without a four-year degree and will provide industry-leading benefits including competitive wages, health insurance, 401(k) program and paid time off.

“Michigan Community Capital is committed to leveraging our tools to bring healthy fresh food to underserved communities in Michigan,” said Eric Hanna, president and CEO at Michigan Community Capital. “Alpena and Clare have both identified bringing more grocery options to their community as a high priority, and we are proud to partner with ALDI as they expand their footprint into Michigan rural markets.”

New Markets Tax Credits are a federal subsidy tool administered by the U.S Department of Treasury and designed to attract capital to projects that support low- and moderate-income households and communities. Michigan Community Capital (MCC) is the only Community Development Entity (CDE) that deploys this resource entirely in the state of Michigan. Since the organization’s formation in 2005, MCC has secured a total of $445 million in tax credit allocation through competitive rounds to support Michigan businesses and communities. MCC uses NMTC’s to support job creation, access to healthy food, and mixed-use projects that include mixed-income housing and commercial businesses that benefit low-income households.

U.S. Bancorp Community Development Corporation is serving as the New Markets Tax Credit investor on this project.

About ALDI

ALDI is one of America’s fastest-growing retailers, serving millions of customers across the country each month. Our disciplined approach to operating with simplicity and efficiency gives our customers great products at the lowest possible prices. For seven years running, ALDI has been recognized by the dunnhumby Retailer Preference Index as #1 in Everyday Low Price.* ALDI strives to have a positive impact on its customers, employees and communities by being socially and environmentally responsible, earning ALDI recognition as a leading grocer in sustainability.** In addition to helping protect the planet, ALDI helps customers save time and money through convenient shopping options via in-store, curbside pickup or delivery at shop.aldi.us. For more information about ALDI, visit aldi.us.

*According to the dunnhumby® ©2024 Retailer Preference Index.

**According to Progressive Grocer’s 2023 Top 10 Most Sustainable Grocers list.

About Michigan Community Capital

Michigan Community Capital (MCC) is a non-profit diversified public-private partnership that supports the missions of the Michigan Economic Development Corporation (MEDC) and the Michigan State Housing Development Authority (MSHDA) by aggregating capital and facilitating the financing and development of low-income and attainable housing, and the redevelopment of complex brownfield sites within the State of Michigan. MCC is a U.S. Treasury certified Community Development Financial Institution (CDFI) and the only Community Development Entity (CDE) that deploys this resource solely throughout the entire State of Michigan. Since 2005, MCC has supported over $1.3 billion in project financing, successfully attracted $445 million in federal New Markets Tax Credits, and helped to create over 1,500 housing units, 4.3 million square feet of commercial, retail and industrial space to facilitate job creation and expansion and has insured over 22,000 affordable multifamily doors. MCC drives community development impacts in four key areas: Real Estate Development, CDFI lending, New Markets Tax Credits, and affordable Property Insurance. michigancommunitycapital.org

###